The JP Morgan of Cryptobanks

Pay with any cryptocurrency in 42 000 000 stores worldwide

limits and commissions

CRPT from all users transactions every month

BONUS SALE

stage ends in:

$0

Collected for nowCrypterium looks like to be the next big thing

Keith Teare, Co-founder of TechCrunch

Cryptobanking potential market

dollars

Token Sale Stages

CRPT — “GAS” in Crypterium transactions

CRPT Monthly Loyalty Function

A cryptobank for everyone

Worldwide

200 000 000

potential clients

Lower costs

up to 8x lower

transaction costs

No Borders

for international payments

100x Faster

transaction speed

up to 100x faster

billion USD — expected revenue

of cryptobanks by 2025

Leading Cryptobank

for the Cryptoeconomy

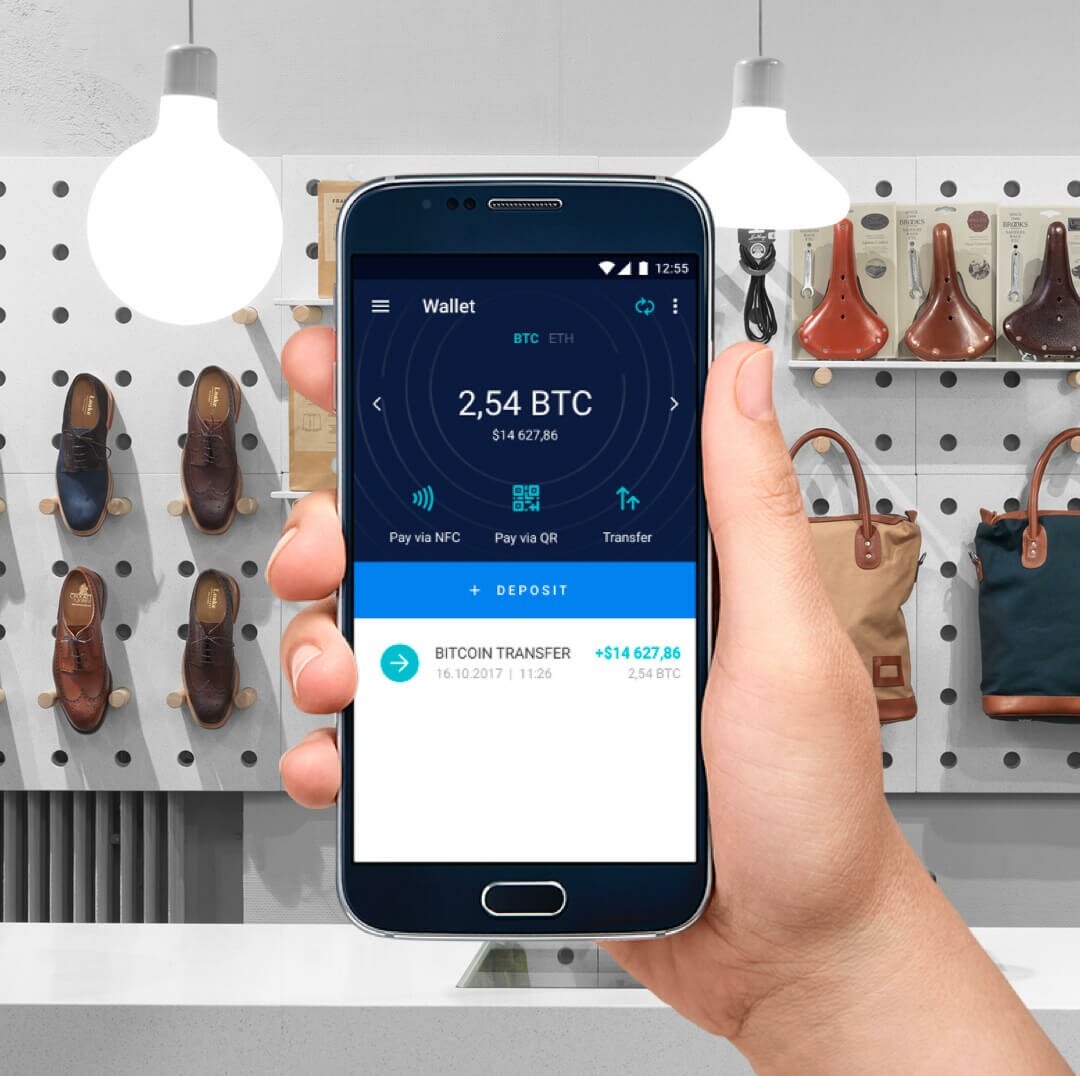

Mobile Cryptobank

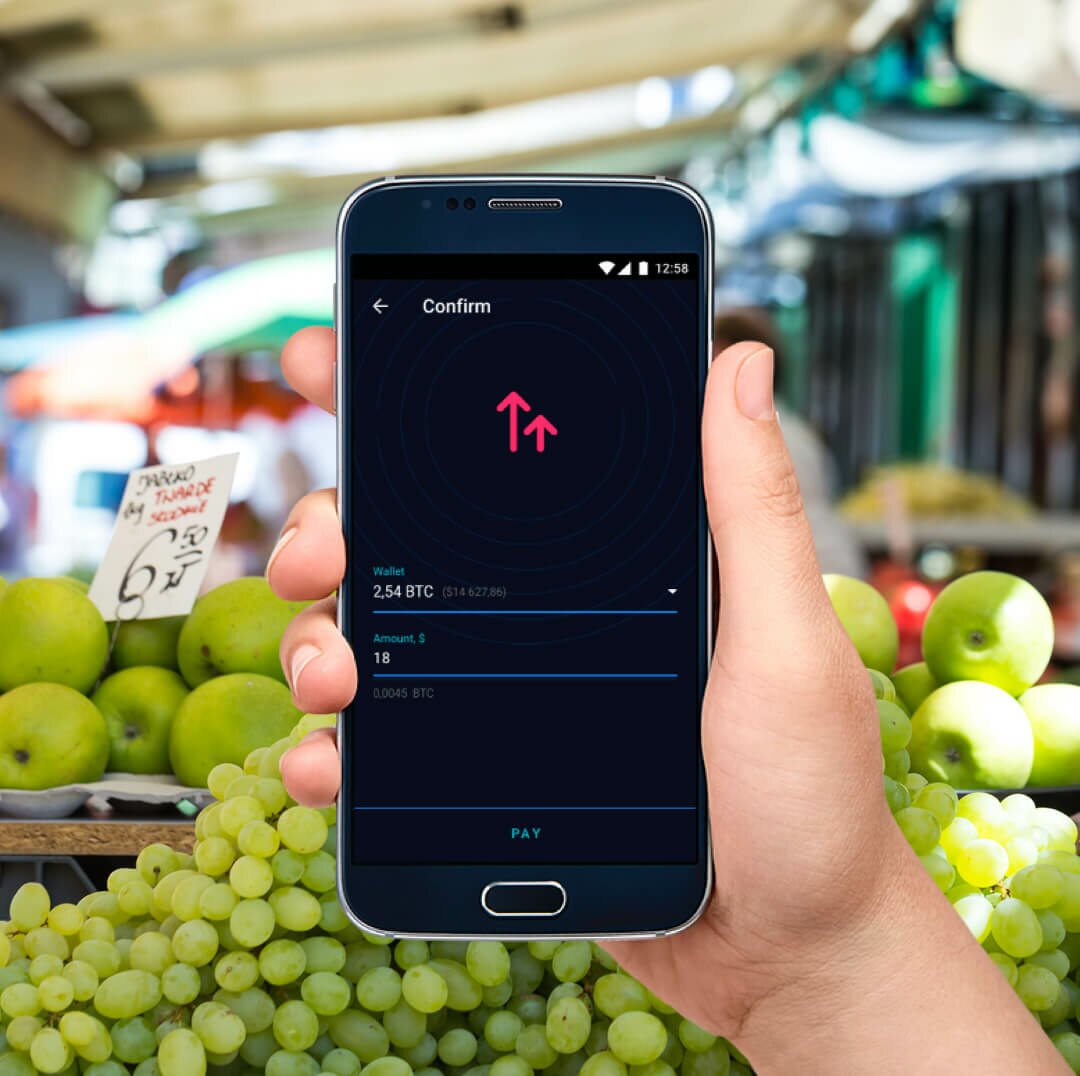

Instant cryptocurrency payments without limits in 42 mln stores

Loyalty programs and cashback

Contactless payments via NFC, QR, ApplePay, AndroidPay

Cryptocurrency Acquiring

Solutions for every sphere of retail trade and services

Native integrations with POS software

Crypto-to-fiat settlements

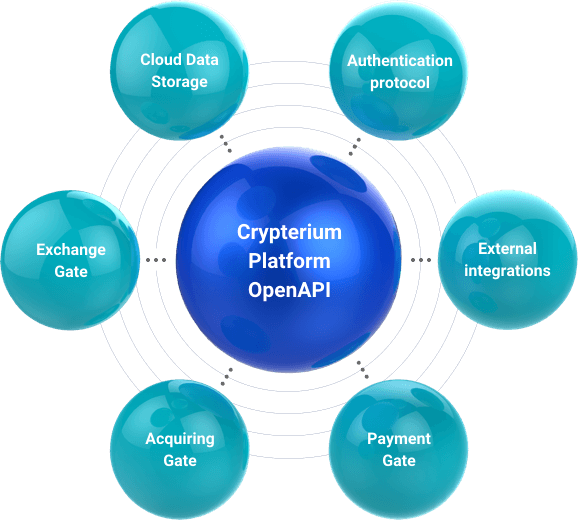

OpenAPI Platform

AppStore for retail cryptocurrency software and solutions

Own decentralized server infrastructure

Third-party integrations – Easy!

Blockchain Based Loans

Instant loans anywhere in the world

Combination of current scoring systems and smart contracts

Unified exchange for liquidity and lowering risks

- Smart Contract Wallet

- PCI-DSS Certification

- Manageable Limits (daily, single)

- Multisig Wallet

- Real-time Fraud Monitoring

- Technical and Financial Audit

Solutions

Crypterium is a contactless cryptobank for everyone

currency exchange, instant loans. Our goal - replace your bank.

- No more wait times for your card to be issued.

You will get your virtual card just after registration. - No limits on transaction volume.

Seriously, no limits in crypto or fiat. - No need for currency exchanges. Instant payments

in fiat money or cryptocurrencies internationally. - Integration with third-party payment wallets or services

(PayPal, Gyft, WeChat, Alipay, PayTM) - Loyalty programs and cashback for every transaction,

increased cashback for token holders. - Contactless payments options – ApplePay, SamsungPay,

AndroidPay, QR code mechanics and many others.

Crypterium SX

Crypterium's technology platform is based on algorithms that ensure the most efficient bid-offer matching across natural peer-to-peer flow as well as third party crypto-exchanges. All historical transactions are stored in a dedicated data-warehouses that continuously analyses the data to enhance risk management and identify predictive behaviours, and in turn enable Crypterium to optimize the cryptocurrency exchange process and better educate the customer on possible payment strategies, for example, it may highlight different payment mixes depending on the current cryptocurrencies valuations. In other words, everything possible is done to ensure that the customer gets the best deal.

Cryptocurrency acquiring solution for merchants

We are creating a global cryptopayments infrastructure

- Merchants receive fiat money even if payment is made in cryptocurrency

- Ready-to-use solutions for e-commerce platforms and site builders

- Commissions are lower than card acquirement — only 0.5%

- In-built exchange, marketing platform and solutions for automatic loyalty programs

- Integrations with main POS software: R-keeper, Inpass, Cegid, Amber, BitQT

18 uniques solution for every sphere of retail trade and services: - SMB, street-retail, HoReCa, e-commerce, transport sphere, vending,

parking and others

Shop

Online store

Street retail

Restaurant

Parking

Technology of a blockchain based credit system

and interest interactions based on blockchain.

1.Credit

2.Exchange

3.100% Guarantee

4.Repurchase

5.Payback

6.Demand

Credit subtoken is a new standard

of cryptocredit based on the blockchain system

- The first subtoken of its kind with secured liquidity

- Owners of credit subtokens receive income much higher than the average market

- Decentralized storage of the reputation of borrowers in smart contracts

- Opportunity to use CRED by other cryptobanks

Read CRED Whitepaper

Crypterium OpenAPI — A banking platform that enables developer solutions for a decentralised economy

- Modular structure enabling easy implementation for different softwares

- Advanced payment and processing technologies, fine-tuned

from more than 3 years of development testing - Unified AppStore for retail cryptocurrency solutions

with a Crypterium products audience - ‘Sandbox’ for early stage development

and debugging software - Opportunity to deploy developed software and services

on a decentralized Crypterium server infrastructure

Tokenholder benefits

CRPT Token Properties

CRPT— “GAS” in Crypterium transactions

is "fuel"

0.5% from every transaction in CRPT tokens is “burned” forever for conducting the transaction. “Burning process” is decentrally regulated by smart-contracts. 0.5% will be calculated based on current exchange rate.

CRPT tokens issued during the ICO are the only tokens which will be issued by Crypterium.

No CRPT tokens will be issued after ICO.

The purchase of tokens during the ICO is the guaranteed way to use Crypterium settlements and purchase CRPT token for fixed price. Users, who has no tokens will have to buy CRPT tokens from tokenholders to use Crypterium ultimate banking possibilities. Crypterium is aimed on list it’s token on exchanges after ICO to support and enlarge userbase.

CRPT supports users and tokenholders

transaction income

Up to 30% of Crypterium’s transactional income forms the Monthly Loyalty Program which is aimed on stimulating users to make more transactions via Crypterium and also to encourage especially active users. Loyalty rewards are made in CRPT tokens, which are purchased by Crypterium from public and private exchanges based on the current exchange rate at the time of purchase.

Each user’s loyalty rewards depends only on the amount of transaction he/she is made during the month in Crypterium services.

Example

The total income of Crypterium for the month was $5,000,000, of which $1,500,000 was used to buy tokens and fill up cashback fund. The distribution will occur this way: imagine that in the platinum group are 1,000 tokenholders, who made transactions for $1,000,000 in total. At the same time, one of the tokenholders made transactions for $10,000, therefore making 1% of the total volume of group's transactions. This means that he will receive 1% of the volume of the token fund in CRPT tokens, which in dollar terms will be $7,500 dollars. This is a good motivation to make further transactions.Our Story

Contactless Payment

Universal tool

Interbanking direct

Road map

implementation. Development of

CrypteriumSX technology

based on OpenAPI

products development

setting up self-regulatory token exchange algorithms

ICO timeline

of unused tokens

Crypterium Expenses

And Corresponding Results

Cryptocurrency

Wallet

Mobile Bank

Solutions

Global Infrastructure

Services

Platform

Services Development

Technology

$3 mlns USD Crypterium Cryptocurrency Wallet

- Processing Center

- Fiat-to-Crypto and vice versa instant exchanges

- NFС payment support (only for Android devices via card emulation)

- Integrations with third-party Cryptocurrency payment infrastructure

- P2P transfers in fiat and crypto currencies

$8 mlns USD Crypterium Mobile Bank

- Implementation of Crypterium SX technology – lower commission on multicurrency operations

- Native contactless payment support (Apple Pay, Samsung Pay, Android Pay, etc.)

- Partnership with banks or financial institutions in every region of financial activities – to guarantee stability and security of settlements

- Integrations with third-party daily financial services (subscription management, accounting, etc.)

$15.5 mlns Cryptoacquiring Solutions

- Contactless payment solutions implementation to inPOS and e-commerce cryptocurrency payments

- Integrations with global POS software

- Fiat money and Cryptocurrency settlement for merchants – no problems in accounting

- More than 5000 POS connected to our own payment infrastructure worldwide

$28 mlns USD Cryptopayments Global Infrastructure

- Solutions for integrating cryptopayments unique mechanics into everyday expenses (transport, automated POS, street retail, etc.)

- Lower commissions on payments and settlements for merchants

- Marketing and bonus platform implementations

- More than 25000 POS connected to our own payment infrastructure worldwide

$31 mlns USD Licensed Banking Services

- Wealth management, brokerage accounts, private banking and retirement planning

- Licensing Crypterium as a European bank

- Lobbying the interests of the blockchain community

- Lower commission on all operations

- Increase in stability, independency and security for all activities

$34.5 mlns USD OpenAPI Platform

- Decentralized server infrastructure

- OpenAPI payments and transactions gates

- Exchange integration support

- Open processing system for corporate projects

- Loyalty and marketing in-built systems support

- Unified standards of operation with cryptocurrency

$36.5 mlns USD Complementary Services Development

- AppStore for blockchain and cryptocurrency solutions

- AppStore for OpenAPI based products

- In-app purchases mechanics

- Complementary services development – escrow, hedging services, “secure” purchase, etc.

- Platforms and services expansion

- Integration with majority of key Cryptocurrency projects

$47 mlns USD Credit Token Technology

- Secured loans by collateral

- Integrations with scoring platforms

- Forming own scoring AI platform

- Credit Token trading exchange development

- Algorithms and mechanics for self-regulated Credit Token exchange rates

- Obtaining a banking license

- Further integrations with blockchain-community projects

- Global association of Cryptoeconomy development

Join us right now and get 6% bonus tokens!

Token Structure

campaign

of tokens:

Technological perfection

Smart Contract

finalized ERC20 standard

Our advisors

Board Member of Coeclerici Spa Russia

of Fembusa Terminals Pte Ltd x

Advisor at Erachain.org

Our team

focus of interest on capital markets in the USA and Russia.

strategist for established and start-up companies.

Professional with over 10 years of experience in the industry.

ventures and a particular focus on simplifying real-world issues through technology.

developer with fintech experience.

FAQ

What is a cryptobank?

What is the difference between a wallet and a cryptobank?

How does credit subtoken CRED work?

A full 6 step credit subtoken CRED diagram can be found in our whitepaper (https://crypterium.io/wp).

What is your team’s background?

When combined, the team has attracted more than $50 million in investments toward fintech projects they have been responsible for creating and developing, including PayQR (Russia’s leading independent contactless payment platform – see further comment below), Workle (a digital sales platform that has over 1.5 million independent users selling everything from credit cards to security alarms) and Bonus Club (a digital loyalty program that is integrated into leading publishers’ websites).

When will you release your mobile app?

When does Crypterium ICO start?

What are the conditions for the pre-sale?

How can I contribute to the Crypterium ICO?

What makes the Crypterium token (CRPT) unique?

What are token holder benefits?

Is there a minimum amount of tokens to buy?

(advertisement / payments

/ exchanges / loans)

(advertisement / payments

/ exchanges / loans)

(Api interactions)

mobile SDK

WEB API, Widgets

Bank integrations

and forecasting

Currency exchanges

integration (SX)

Credit and loans

market integration

Event driven

marketing

UCS Online

Metropolitan

PayU

Rakuten

CJ Affiliate

Magento

osCommerce

CS-Cart

Yii Framework

Drupal

Image

Amiro

Moguta

FICO

5 reasons why you should

buy CRPT tokens

All tokens will be issued only during ICO. This is coded in the CRPT Smart Contract, therefore it is 100% guaranteed by decentralized blockchain protocol. There will be no tokens issued after ICO.

All Crypterium solutions require CRPT tokens for usage and the amount of tokens in circulation will constantly decrease. The CRPT token is the fuel for Crypterium transaction processing. With every transaction, a small number of CRPT tokens are “burned”.

By owning CRPT tokens and making transactions you will automatically become a member of our Loyalty Program, which provides cashback up to 80% for every transaction you make.

We worked closely with one of the best lawyers in blockchain and the SEC regulation sphere. Our legal opinion is that CRPT tokens are a utility and not a security. This guarantees a fast listing on exchanges after ICO.

The team who developed CRPT Smart Contract has 5 years of experience in blockchain solutions. We also secured a technical audit from Ambisafe, who confirmed the quality and security of our Smart Contract.

5 reasons why Crypterium is actually the next big thing

We started creation of the most capable and convenient payment processing solution 7 years ago. Crypterium is the cumulative peak of that collaboration, utilizing the most efficient technology developed by our experienced team.

Crypterium’s goal is not just to create another cryptowallet or bank cryptocard. We focus only on future technologies and infrastructure, using contactless payment technologies and creating full-fledged banking solutions.

Crypterium will erase geographic and mental boundaries between different currencies and cryptoassets by guaranteeing the lowest exchange rate and immediate exchanges, using CrypteriumSX technology. Payment transfers and other transactions are quick and easy – no different than working in the currency of your own country.

The biggest difference between cryptocurrency and fiat is that cryptocurrencies can not generate standard interest profit like a banking system. We are creating solutions which will enable the generation of interest profit in a blockchain based world.

Why have a variety of services if you can’t access them quickly and easily? We are focused on mobile technologies to ensure we provide banking services with no limits, restrictions or delays.